Buy Woke, Go Broke: The Failure of ESG Investing

By Tilak Doshi

Terrence Keeley is a long-time ESG practitioner who until recently headed the official institutions group in the world’s largest asset manager BlackRock advising sovereign wealth funds, central banks, finance ministries, and public pension funds. He claimed in 2022 that “ESG investing could well be the biggest thing in finance since the Dutch East India company issued shares in 1602…ESG’s success or failure could literally impact every living creature on Earth.”

Mr. Keeley’s boss, Larry Fink, chief executive of BlackRock, was equally hyperbolic in his annual letter to CEOs in early 2020:

We believe that sustainability should be our new standard for investing…all investors – and particularly the millions of our clients who are saving for long-term goals like retirement – must seriously consider sustainability in their investments…I believe we are on the edge of a fundamental reshaping of finance.

Alas, the ESG and sustainability movement, a financial juggernaut in its heyday, has performed poorly in the past two years.

This poor performance has been a result of a combination of factors including the boomeranging impact of Western sanctions on Russia energy exports, the collapse of “clean” energy stocks, the rise in interest rates, and the widespread backlash against ‘woke capitalism’ and climate change regulations in Europe and the U.S.

ESG investment momentum has slowed on both sides of the Atlantic since 2022. In 2022, for the first time in more than a decade, investors pulled more money from funds marketed as “sustainable” than they added. In the first half of 2024, the U.S. ESG market experienced net outflows of over $13 billion, on the heels of a $9 billion outflow in 2023. Morningstar, a financial research firm, found nearly 2,500 fewer sustainable funds globally in 2023 relative to the prior year and 2024 is on track for an even steeper plunge.

According to Torsten Lichtenau, Bain and Company’s global carbon transition practice lead, “When you look at the importance of [environmental, social and corporate-governance efforts], you can clearly see a huge peak in 2021 to 2022 where there was also a lot of action off the back of the Glasgow COP26 climate conference in 2021. Now it’s dropped back to 2019 levels.”

Competitive Sustainability

Enter “competitive sustainability”, a buzz phrase of choice of its most vociferous proponents. The European Commission’s 2022 Annual Sustainable Growth Survey (ASGS) presented a “competitive sustainability” agenda for the EU covering four dimensions: productivity, environment, fairness, and stability. In a word salad worthy of Brussel’s unelected bureaucrats, it describes the agenda as one where “a fair, just, green and digital transition which requires sustainable social conditions, will serve as a foundation for future prosperity and resilience. Well-designed labour market policies and social protection systems are the basis for resilience and inclusive growth.”

In offering a Panglossian world where all good things go together – high productivity, environmental sustainability, fairness and stability – “competitive sustainability” is now the battle cry for the Cambridge Institute of Sustainable Leadership (CISL). It is mom’s venerable apple pie, something no reasonable person could object to. There are no difficult trade-offs to be made since “competitive sustainability” ensures both economic growth and environmental sustainability, not to mention equity and stability.

In an article published in the Financial Times last month, the interim CEO of CISL Lindsay Hooper begins by saying: “The business case for sustainability is clear: companies cannot thrive on a planet suffering from cascading crises and unmanageable risks. Yet, despite decades of corporate commitments, businesses continue to damage the planet, carbon emissions to rise and fossil fuel companies to chase growth.”

Ms. Hooper asserts that “It is time to confront the uncomfortable truth: ESG as it stands – grounded in disclosures and voluntary market action – will not deliver the necessary change. The solution is a radical shift towards ‘competitive sustainability’.”

What does this “radical shift” entail? To deliver change, Ms. Hooper says we must “redesign” penalties and incentives which “will require a critical mass of businesses to push for government action”. Evidently, market decision-making in the context of disclosure rules and voluntary action by company executives is not enough. She finds it imperative that governments “create conditions that make it economically compelling to phase out damaging activities. Otherwise businesses that voluntarily transition will be undermined by those that don’t.”

There we have it, straight from the hallowed halls of academe. Governments – presumably advised by sustainability-congruent academics – must replace markets by diktats that determine which industries are pursuing “damaging activities” and need to be proscribed, and which are not. An extreme case of governments picking winners.

The familiar trope of market myopia is trotted out by Ms. Hooper: “As long as the market rewards short-term gains over long-term resilience, businesses will harm the planet, and markets will destroy the foundations on which they depend.” Evidently, Mr. Hooper seems not to be too concerned about the “short-termism” of governments bound by electoral cycles.

Meanwhile, in the Real World…

Firms favoured by ESG investment metrics – the “non-damaging activities” as per Ms. Hooper – such as wind and solar system providers, electric vehicle manufacturers, “green” hydrogen producers, and other such “sustainable” entities have been having a hard time after initial enthusiasm and high IPO values.

The Renewable Energy Industrial Index (RENIXX) is a global stock capitalisation index of the 30 largest renewable energy industrial companies in the world including First Solar, Gamesa, Orsted, Plug Power, Solarcity, Tesla, and Vestas. Established on May 1, 2006, with an initial value of 1,000 points, the index stood at 1,013 points on September 25th, essentially registering zero value growth over the last 18 years. In comparison, the S&P 500 Index more than quadrupled over the same period. The RENIXX is down three years in a row from 2021, losing half its value. It should be noted that that this performance would have been far worse if the outperforming Tesla stock was removed from the index.

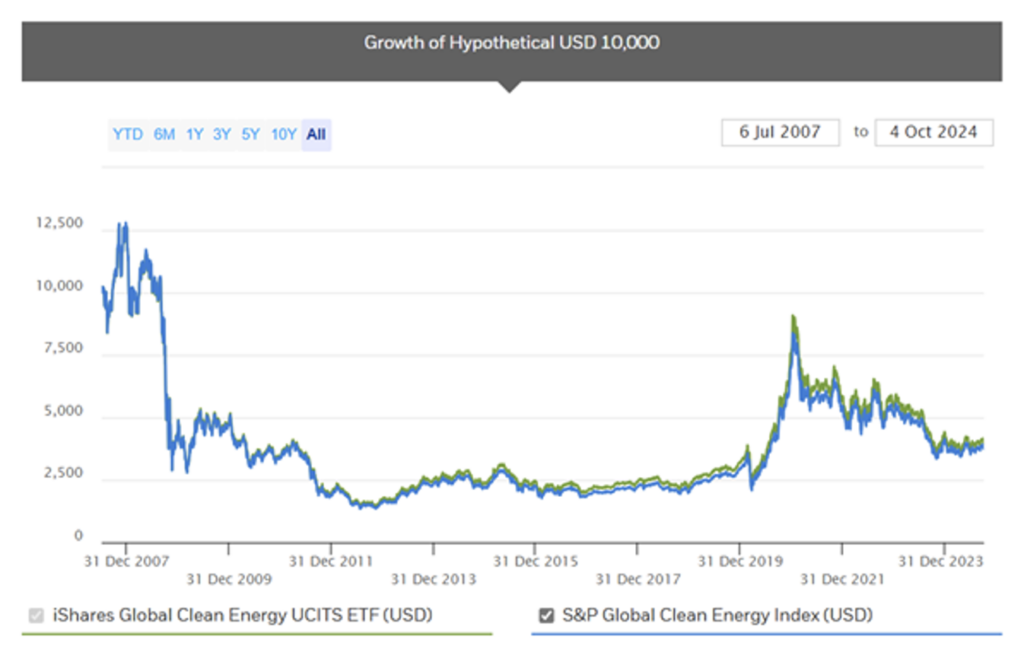

The iShares Global Clean Energy ETF aims to “target access to clean energy stocks around the world”. Last year its value fell by 26.1% and from its inception in 2008 it has lost about 60% of an initial investment of $10,000.

Perhaps the best example of ESG-inspired debacles is provided by bp, the hitherto “woke” oil company that has used lower-case letters for its name and logo since 2000. In the high road of the climate crusade, marked by corporate brochures extolling social responsibility and environmental sustainability, the company was first among its peers. Its then-CEO John Browne – now Lord Browne – declared in a 2020 speech at Stanford University: “We need to reinvent the energy business. We need to go beyond petroleum.”

According to an article in the Telegraph published on Monday, bp has abandoned its target to cut oil and gas production by 2030 “as its new chief executive scales back a switch to green energy to boost its share price”. Its new CEO Murray Auchincloss plans to focus on investments in oil and gas projects in the Middle East and the Gulf of Mexico to boost output. Quite unsurprisingly, in the real world where money matters, the company’s shares rose as much as 1.3% after the story was first reported by Reuters. Perhaps rather late in the day, the company’s senior management has decided that its fiduciary duties to maximize shareholder profits trump its devotion to “sustainability”.

Them Weasel Words

The question about the ethically appropriate role of business firms in societies in which they operate is as old as the business firm itself. Adam Smith, a keen observer of businesses – he authored An Inquiry into the Nature and Causes of the Wealth of Nations after all – was not at all uncertain in his response to this question in 1776: it is from the appeal to the self-interest of the butcher, the brewer and the baker that we expect our dinner, not to their benevolence. He had also “never known much good done by those who affected to trade for the public good”.

Almost two centuries later, Smith’s most famous acolyte Milton Friedman was just as clear: “There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.”

He too was distrustful of businessmen who talk of promoting desirable social ends, for they are “unwitting puppets of the intellectual forces that have been undermining the basis of a free society these past decades”.

In the battle of the greatest weasel words of recent years, “ESG” and “competitive sustainability”, along with their corollaries such as “energy transition” and “net zero by 2050”, surely come out at the top.

It is not capitalist free markets but those that seek to replace them that threaten to destroy the foundations of modern civilization.

This commentary was first published at Daily Sceptic on October 13, 2024.

Dr. Tilak K. Doshi is an economist, a former contributor to Forbes, and a member of the CO2 Coalition.